Private Equity

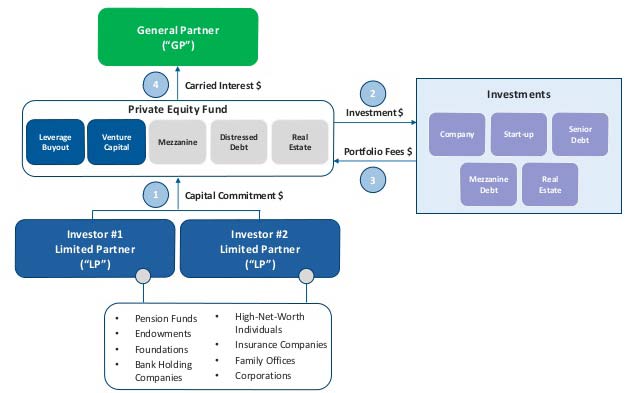

Private equity is a source of investment capital from high net worth individuals and institutions for the purpose of investing and acquiring equity ownership in companies. Partners at private-equity firms raise funds and manage these monies to yield favorable returns for their shareholder clients, typically with an investment horizon between four and seven years.

These funds can be used in purchasing shares of private companies, or in public companies that eventually become delisted from public stock exchanges under go-private deals. The minimum amount of capital required for investors can vary depending on the firm and fund raised. Some funds have a $250,000 minimum investment requirement; others can require millions of dollars.

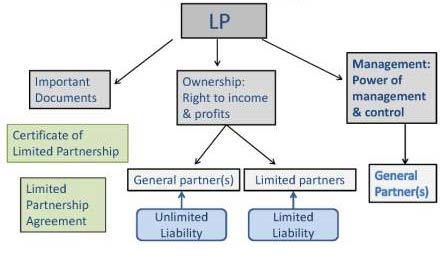

Limited Partnership

A limited partnership (LP) exists when two or more partners unite to jointly conduct a business in which one or more of the partners is liable only to the extent of the amount of money that partner has invested. Limited partners do not receive dividends, but enjoy direct access to the flow of income and expenses. This term is also referred to as a "limited liability partnership" (LLP). The main advantage to this structure is that the owners are typically not liable for the debts of the company.

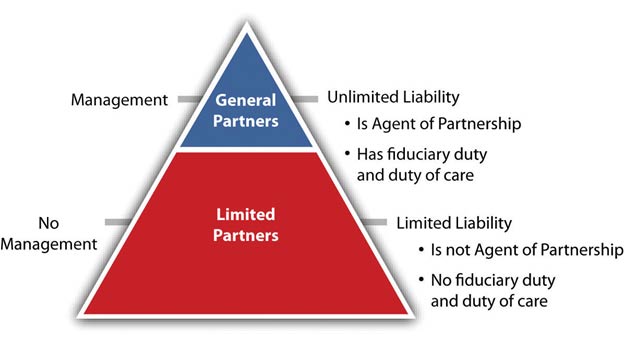

General Partnership

A general partnership is an owner of a partnership who has unlimited liability. A general partner is also usually a managing partner and active in the day-to-day operations of the business. Because any partner in a general partnership can act on behalf of the entire business without the knowledge or permission of the other partners, being a general partner offers poor asset protection.

If a general partner is ever required to meet the partnership's financial obligations, his or her personal assets may be subject to liquidation. In the case of a limited partnership, only one of the partners will be the general partner and have unlimited liability. The other partners will have limited liability as long as they do not take an active role in managing the business, so their personal assets will not be at risk.

How can we help you?

As the main forms of private equity general partner(GP) and limited partner(LP) have always had a symbolic relationship. It is not easy to decide which part to take if you are lack of fruitful knowledge about private equity. Also the investment institutions are more inclined to GP as they can manage the firm for the benefit of LPs. So how to work with reliable GP, and how to make the investment portfolios across multiple GPs or a single one. Co-investment is an attractive alternative, but it is hard to find the most effective and fee-efficient method of implementing the portfolios. You are now in the right place to consult this kind of investment or the models you want to take part in.